Solar energy for farmers is an intriguing concept. What if you could eliminate one of your farm’s biggest monthly expenses without significantly changing your day-to-day operations?

With solar power for agriculture, you can.

By swapping utility-generated electricity for renewable energy generated by your solar system, you can virtually eliminate your monthly electricity bill.

While there are large-scale solar farms that act like mini power plants generating solar energy for off-site use, we’re not talking about that here. We’re talking about installing your own solar system to offset the electricity used at your farm.

Agricultural solar energy systems are designed to generate enough power to run some or all of your farms’ operations, offsetting your electricity bill with clean energy. You’ll be the owner of your own solar system. And in return, you’ll get the full share of all the benefits solar panels have to offer.

That said, solar energy is not a good investment for every farmer. In this blog, we’ll take a look at some of the advantages and disadvantages of solar energy for farms and other agricultural properties to help you decide if it’s a wise investment for you.

The Advantages of Solar Power in Agriculture

Solar Power Will Reduce Your Farm’s Operating Costs

Whether it’s running exhaust fans for livestock or processing equipment for harvested crops, there are likely several months out of the year where electricity is one of the farm’s top expenses.

While solar power won’t eliminate your need for electricity, it will give you access to it for, well, free.

Installing a solar system allows you to use the free electricity it produces each month to offset all or a portion of your monthly power usage.

Depending on your system’s cost and energy usage, your system could have paid for itself after just a few years, possibly leaving decades of its 25 to 30-plus-year lifespan to produce free electricity. That frees up the money you would have spent on electricity to save or invest back into your farm.

You’ll Benefit from Tax Savings

If you’re looking for a way to keep more of your hard-earned money by reducing your tax burden, consider installing solar.

The Solar Investment Tax Credit (ITC) allows you to recoup 30% or more of your solar system’s installation cost through a tax credit. However, the federal tax credit is coming to an end. While it’s available until 2027, the rules for qualifying become much stricter after 2025. Learn more about how the federal solar tax credit works.

In addition to the tax credit, there is another tax-saving incentive: 100% bonus depreciation. This allows you to accelerate 100% of the federal depreciation savings to the year your system is placed into service. Your state depreciation will follow the five-year MACRS schedule.

Solar Will Future-Proof Your Farm for the Next Generation

While electricity prices vary from year to year, it’s reasonably safe to say that they’ll continue to increase in the long run. What may be a manageable expense for your farm now may not be so for the farm 15 or 20 years from now.

If your farm is a family legacy that’s handed down from generation to generation, a solar system you install during your tenure will continue to benefit future generations. Or, if you’re looking to sell your farm and retire, a solar system can increase the value of your property, giving you a bigger cashout.

Solar is a Low-Maintenance and Low-Risk Investment

There’s no shortage of farm equipment you could invest in. However, many of these large machines, like tractors or processing equipment, require labor to operate and labor to maintain.

Solar, on the other hand, works with no input from you and is relatively maintenance-free. While you can have your solar panels cleaned, regular rainstorms do a sufficient job in most places.

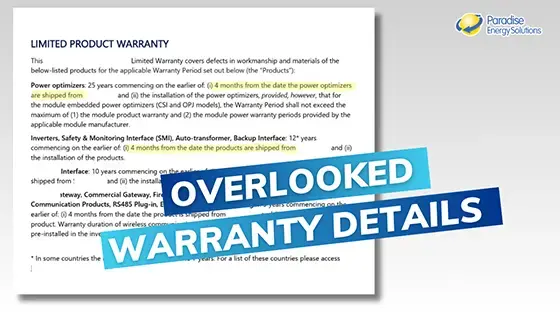

And as long as you install quality equipment and use a qualified installation company, your system should be protected by warranties in the event something does go wrong. Additionally, some solar installers offer protection on top of manufacturer warranties, like Paradise Energy’s Triple Ten Guarantee. This protects against workmanship issues and the system’s production, as well as ten years of system monitoring.

Additionally, investing in a tractor or other piece of farming equipment is unlikely to yield the same tax savings as solar. The tax savings is money back in your pocket almost immediately, so that’s money you can reinvest back into your farm. If you install solar first, you could use the money saved in year one to purchase that piece of equipment without needing any additional capital.

The Disadvantages of Solar Energy in Agriculture

Solar Ground Mounts Take Up Land

There are two main types of solar systems: roof mounts and ground mounts.

With roof mounts, you can install solar panels on any building on your farm, provided it can support the additional weight and receives sufficient sunlight. Whether it’s the roof of a poultry house or a barn housing your equipment and materials, you can put a previously underutilized space to work.

If you don’t have a building with a roof conducive to solar, you may want to opt for a ground mount. However, this will take up land that you could otherwise use for farming, reducing your crop yield.

When evaluating whether or not installing solar on your farm is the right thing to do, weigh how much money you’d make by farming that land versus how much you’ll save with solar panels.

When it comes down to it, a system that’s designed to offset just your onsite electricity usage likely won’t take up a significant portion of land.

That said, some farmers still find ways to put the land around and beneath the solar array to use once the system has been installed. Some farmers grow shade-tolerant crops beneath the panels or even allow smaller, free-range animals to use the panels as shade. Note that this may require increasing the clearance of the panels, which also increases installation costs.

Solar Requires an Upfront Investment

Despite the cost-saving incentives and promising long-term savings, solar installation comes with upfront costs.

Just how much is the initial cost? While this depends on a variety of factors, the most influential one is the size system you need.

Let’s look at a 100 kW system, which should produce enough electricity to cover a $1,200 electricity bill. Before any incentives, it’ll cost about $238,600. After the tax benefits, the cost would be $114,147.

Think of it this way. Paying to install a solar system is like pre-paying for your electricity for the next five or ten years (this depends on your system’s payback period, which will vary with system cost and electricity usage). But in return, you’ll have free electricity for the next 20, 25, or more years.

Solar Panels Need Direct Exposure to Sunshine

Constant and direct exposure to sunshine is essential to the success of your solar system.

That said, you don’t need to live in Arizona or Florida to make going solar worthwhile. Solar can be a great investment even in particularly cloudy areas of the country.

You may need to install a few extra panels to make up for the production lost due to cloud coverage, but with falling installation costs and rising electricity prices, it isn’t likely to have a significant impact on your system’s ROI.

Find out whether or not your area gets enough sunshine for solar energy.

Additional Equipment is Needed if you Want Backup Power

A farmer’s work is never done, not even when the electricity goes out.

It’s easy to assume that if you have your own solar system, you’ll be able to use electricity even when the grid goes down. However, if you have a grid-tied solar system, that won’t be the case unless you invest in additional equipment.

In order to maintain the safety of the utility employees, it’s required that your solar system shut off until the grid is back up. That means even if the sun is shining brightly, you won’t be able to use electricity until the power goes back on.

One way around this is to install an energy storage system in addition to your solar system. These batteries will collect and store solar-generated electricity that can then be used to power select loads in the event of a power outage.

The downside is that they’ll make installing your solar system more expensive and won’t necessarily improve your system’s ROI. However, some state incentives could help reduce the cost of a battery installation. If you don’t want the additional cost of batteries, installing a generator is a cost-effective alternative.

Solar Energy Grants and Incentives for Farmers

Farmers looking to invest in solar energy can take advantage of a variety of grants and incentives specifically designed to make renewable energy projects more affordable. These programs can significantly reduce the upfront costs of installing solar systems, helping farmers to achieve long-term savings and sustainability. Here are some key grants and incentives available for farmers:

State and Local Incentives

Many states, and some utility companies, offer additional incentives for solar energy projects, including grants, tax credits, and rebates. These programs vary widely by state, but they can provide substantial financial support for farmers investing in solar energy. For example, states like California, New York, and Massachusetts have robust incentive programs that can further reduce the cost of solar installations.

Farmers can find specific state and local incentives through the Database of State Incentives for Renewables & Efficiency (DSIRE) here.

Property-Assessed Clean Energy (PACE) Financing

Property-Assessed Clean Energy (PACE) financing is a unique financing option available in some states that allows farmers to finance the cost of solar energy installations through a special assessment on their property taxes. This can spread the cost over many years, making solar investments more manageable.

Farmers can learn more about PACE financing and check its availability in their state here.

What Does the Future Hold for Solar Power in the Agricultural Industry?

As the agricultural industry continues to evolve, solar power is poised to play an increasingly significant role. With ongoing advancements and innovations, the future of solar energy in agriculture looks promising. Here are some trends and potential growth areas to watch:

Increased Adoption of Agrivoltaics

Agrivoltaics, the simultaneous use of land for both solar power generation and agriculture, is gaining traction. By installing solar panels above crops or grazing land, farmers can maximize land use and create a mutually beneficial environment.

The shade provided by solar panels can reduce water evaporation, protect crops from extreme weather, and even improve plant growth in some cases. This innovative approach is expected to become more popular as farmers seek to optimize land use and increase sustainability.

Advances in Solar Technology

Continued advancements in solar technology are making solar systems more efficient, affordable, and versatile. For example, bifacial solar panels, which capture sunlight on both sides, can significantly increase energy output.

Additionally, improvements in energy storage solutions, such as more efficient and cost-effective batteries, will enhance the reliability and resilience of solar power systems, providing farmers with a consistent energy supply even during periods of low sunlight.

Common Questions about Agricultural Solar Panel Systems

How much farmland will solar panels take up?

It ranges from zero land if you use a roof-mount to only a few acres for most agricultural solar panel systems. As a rule of thumb, offsetting a $1,200/month electric bill (≈ 100 kW array) needs about 8,500 ft² or roughly 0.2 acres.

Will solar panels contaminate my soil?

No. Solar modules are made primarily of silicon and aluminum which are both naturally occurring elements that pose no toxic leaching risk. Even the small amount of aluminum in racking posts hasn’t been shown to affect crop yields except in highly acidic soils.

Can I farm the land once the panels are uninstalled?

Yes. Panels typically last 25–30 years. After racking and wiring are removed, the ground can be returned to normal agricultural use without remediation.

Can I grow crops under solar panels?

Yes. This practice is called agrivoltaics. Properly spaced ground mounts keep temps cooler by day and warmer at night, so many vegetables and shade-tolerant crops grow just as well (or up to 20% better in some studies) while needing less irrigation.

Are animals affected by solar panels?

Panels emit no radiation, so livestock are safe. The main risks are chewing on wires or heavy animals bumping panels. Fencing or raising the array to ~4 ft lets sheep or poultry graze while protecting equipment.

How much does it cost to install solar panels on a farm?

Most farm-scale solar panel systems run $60k to over $500k after incentives, depending on size. Larger arrays generate more free power and typically pay for themselves in under 10 years thanks to grants, tax credits and accelerated depreciation. Learn more with our Solar Panel ROI calculator.

What maintenance do solar panels require?

Very little. Rain usually keeps modules clean. Annual visual checks plus remote monitoring catch most issues, if any. In dusty regions you might schedule a professional wash – DIY cleaning could void warranties. Snow generally slides off as panels warm in sunlight.

Will the installation process slow down my farm?

Installations are non-invasive and can be scheduled any season. Most ag projects take several days to a few weeks, and crews coordinate traffic flow so barns, lanes and equipment stay accessible throughout the build.

Should You Consider Agricultural Solar Power at Your Farm in 2025?

Solar power has advantages and disadvantages for farmers. On the plus side, solar is a set-and-forget solution to reduce operating expenses and taxes. In addition, you’ll be investing in the long-term sustainability of your farm and lessening its dependence on fossil fuels, whether that benefits the next generation in your family or you when you sell the farm.

On the downside, it’s a relatively substantial upfront investment that may end up taking a small portion of your land if your roof is not suitable. When it comes down to it, solar can be a great investment for your farm, but it isn’t for every farm.

If you’re ready to learn more about how solar could help your farm, request your free custom quote. This will empower you with all the information you need to make an informed investment decision that will impact your farm’s profitability for the next 25+ years.