Ohio Solar Panel Installer

Custom solar energy installations for

businesses, farms and homes

Ohio Branch Office

Phone

Local Phone: (330) 852-4194

Toll Free: (877) 851-9269

Fax

Fax: (330) 852-4199

Ohio’s Top Solar Installer

Tired of paying the electric company every month? Frustrated at the always-increasing energy bill? Put a stop to it by installing solar energy for your business, farm, or home. Learn how your neighbors and competitors in Ohio are reducing their monthly costs, lowering their taxes, and increasing profits by switching to solar.

Transitioning to solar is a significant step forward, but what about after your system is up and running? Paradise Energy supports you whether we install your solar system or another provider. Our comprehensive maintenance plan, Paradise Protects, ensures your solar investment continues to operate smoothly and efficiently, safeguarding your investment over time.

From our Sugarcreek, Ohio, office, we extend our solar installation and maintenance services across the state, including:

- Akron

- Canton

- Cambridge

- Cleveland

- Columbus

- Mansfield

- Medina

- New Philadelphia

- Tiffin

- Westlake

- Wooster

- Youngstown

- Zanesville

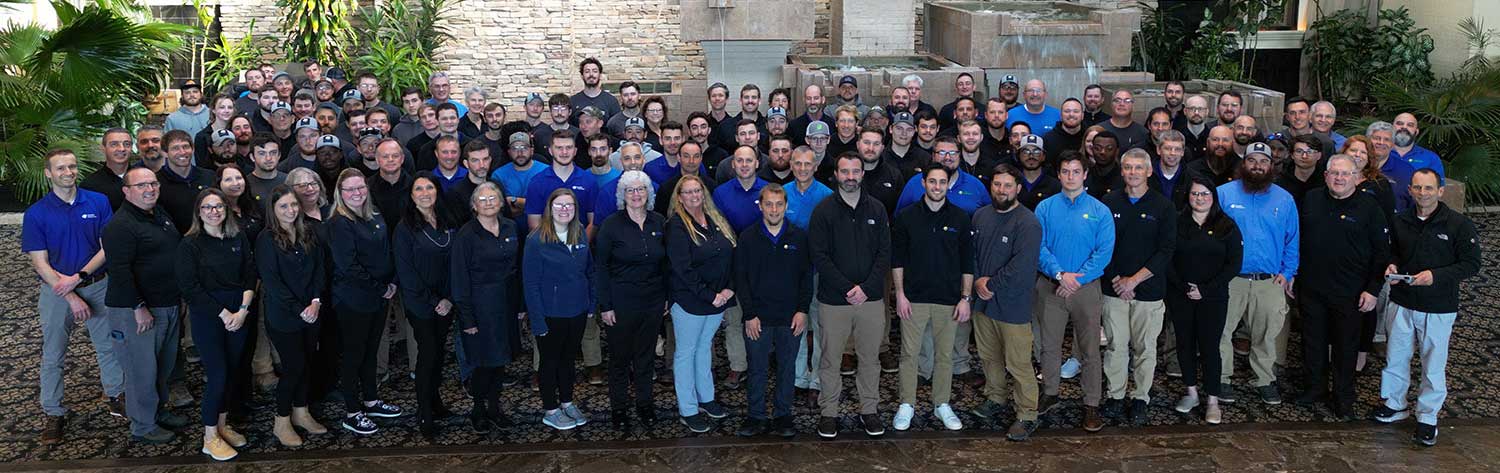

Meet our Ohio Staff

Jeff Menk

Sheldon Stutzman

Christopher Roach

Michelle Miller

Zane Gardner

Daniel Burch

Tim Dollard

Austin Renner

Jeremy Sommers

Hunter Yoder

Bret Hostetler

Samuel Gibble

Brandon Sommers

Gabriel Siegrist

Brandon Bolyard

Chance Menefee

Colton Herrington

John Bowersock

Available Solar Incentives in Location

30% Federal Tax Credit

For Commercial & Residential Installations

USDA Loans & Grants

For Qualifying Projects

Solar Renewable Energy Certificates (SRECs)

are available in Ohio