Pennsylvania's Solar Panel Installer

Custom solar installations for

PA's businesses, farms, and homes

Pennsylvania Branch Office

Phone

Local Phone: (717) 288-2799

Toll Free: (877) 851-9269

Fax

Fax: (717) 288-3974

PA’s Leading Solar Installer

Our Pennsylvania team of experienced solar installers has helped PA businesses, farmers, and homeowners save money with solar energy installers.

Transitioning to solar is a significant step forward, but what about after your system is up and running? Paradise Energy supports you whether we install your solar system or another provider. Our comprehensive maintenance plan, Paradise Protects, ensures your solar investment continues to operate smoothly and efficiently, safeguarding your investment over time.

From our office in Lancaster County, PA, we serve business owners, farms, and homeowners throughout Pennsylvania. We provide solar installations and system maintenance all over PA, including:

- Lancaster

- Allentown

- West Chester

- Harrisburg

- Chambersburg

- York

- State College

- Lebanon

- Carlisle

- Pittsburgh

- Reading

- Scranton

- Altoona

- Lewisburg

- West Chester

- Langhorne

- Carlisle

- Shippensburg

Towanda Office

Phone

Local Phone: (877) 851-9269

Toll Free: (877) 851-9269

Fax

Fax: (717) 288-3974

PA & NY's Best Solar Installer

Farmers, homeowners, and business leaders in Northern PA and Southern NY are discovering the advantages of installing a solar energy system, including cutting your monthly costs, reducing taxes, and protecting against future price increases.

See how solar can impact your monthly budget or bottom line by requesting a free quote today.

Our Towanda, PA office serves all of Northern PA and Southern NY, including:

- Steuben, NY

- Elmira, NY

- State College, PA

- Ithaca, NY

- Potter County, PA

- Williamsport, PA

- Jamestown, NY

- Allegany County, NY

- Edinboro, PA

- Tioga, PA

- Binghamton, NY

- Bradford, PA

- Warren, PA

- Susquehanna County, PA

- Sullivan, PA

- Montrose, PA

- Troy, PA

- Scranton, PA

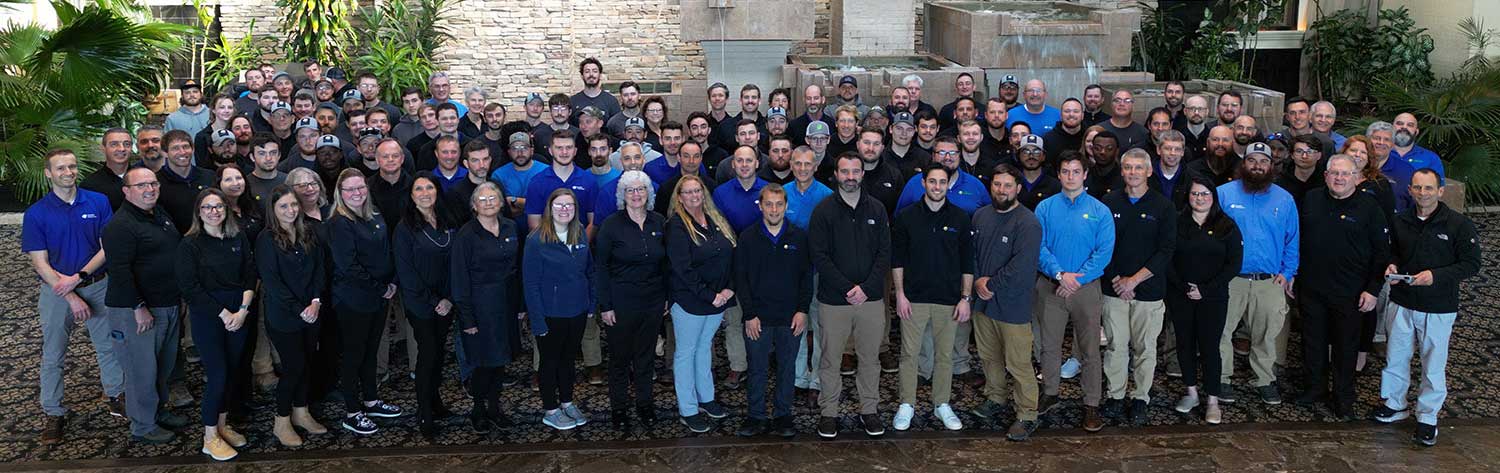

Meet our Pennsylvania Solar Experts

Austin Kling

Marty Clemmer

Sheldon Martin

Fred McNeal

Brian Foltz

Soleiman Paracha

Jose Pabon

Charlie Allen

Jonathan Good

Matthew Miller

Jorden Wing

Mohammed Noorzaie

Amanda McClary

Ethan Balmer

Matt Bland

Brian Kephart

Alex Nissley

Steve Canapp

Adam Wojcik

Eric Koch

Parker Stoner

Conner Minnich

.jpg?width=310&height=200&name=Dawson-Spitler-Service-Technician-O%26M%20(1).jpg)

Dawson Spitler

Ron Herr

Mark Neale

Dominic Vivona

Colin Marquis

Lachlan Robertson

Cody Kleinsmith

Collin Truitt

Evan Hudson

Esai Olaya

Eugene Campbell

Brad Benedum

Christian Freas

Evan Schulz

Cole Gruver

Sam McFetridge

Hank Williams

Max Rohr

Paul Beighley

Adam Bradley

David Huxley

Elias Worthington

Carson Cheyney

Solar Incentives Available In PA

30% Federal Tax Credit

For Commercial & Residential Installations

USDA Loans & Grants

For Qualifying Projects

Solar Renewable Energy Certificates (SRECs)

are available in Pennsylvania