To put it simply, solar can be a fantastic financial and eco-friendly investment for many businesses, but it isn’t for everyone. Deciding whether or not to go solar can greatly impact your business’s bottom line. To understand how solar can help or not help, you need unbiased, accurate information.

Our 2024 guide to solar energy for businesses is the perfect resource for any business owner considering moving to solar power.

So, to help you understand whether solar energy is right for you, we’ve put together a list of pros and cons specific to solar energy for businesses in our commercial solar panel guide. These will help you understand solar’s benefits and disadvantages to your business.

Advantages of Solar Energy for Businesses

Solar Energy Reduces Your Overhead

It’s a simple business equation: when you reduce overhead profits increase. All businesses strive to boost efficiency and bolster the bottom line. Solar energy is one easy way you can achieve this.

Installing a solar system allows your business to produce its own free electricity, knocking down a significant and unavoidable monthly expense. These savings are something you can get used to. Many solar panels are guaranteed for up to 25 to 30 years and may operate even longer, so you’ll be producing free electricity for decades.

Installing Solar Means Great Tax Incentives

Solar energy is great for the environment, and the government likes it. They want more businesses to invest in solar, so they’re making it even more affordable with substantial tax-saving incentives.

The Solar Investment Tax Credit (ITC) allows businesses to recoup 30% or more of their system’s cost through a credit on their federal taxes. However, the tax credit is coming to an end in 2027, and qualifying for the the credit after 2025 will become more challenging.

Another valuable tax-saving incentive is bonus depreciation. This allows you to accelerate 100% of the federal depreciation savings to the year your system is placed into service. The state depreciation will follow the 5-year MACRS schedule.

Solar Protects You From Rising Electricity Rates

While electricity prices may vary slightly from year to year, they’ll almost certainly get more expensive in the long run. With a solar energy system, you’ll future-proof your business against rising rates.

Your electric bill 15 years after you install your system will most likely be higher than it was the year your system was placed into service. So, depending on the degradation of your panels and your electricity rate, the money your solar system is saving you could actually be greater in year 15 than in year one.

Solar Systems Are Low Maintenance

Business owners have enough to worry about and take care of as it is. Adding another item that requires significant maintenance and upkeep may be too much to take on. However, you may be surprised to hear that solar systems require little regular maintenance.

While you certainly can have your panels cleaned if you’d like to, regular rainstorms do a sufficient job in most cases. If your panels are in a drought-prone area or in a particularly dusty area, an occasional cleaning could be beneficial

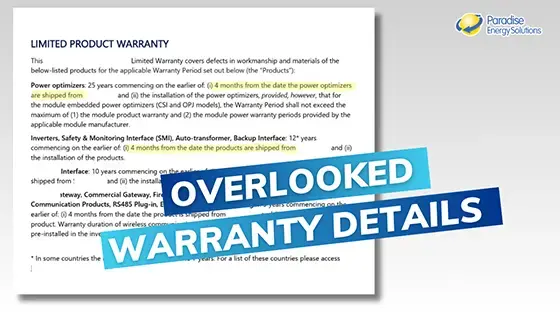

If you choose quality solar equipment backed by substantial warranties, the manufacturer will protect your investment should it not perform up to spec. Similarly, if you choose a solar installer that offers its own warranty on workmanship, production, and monitoring, like Paradise Energy’s Triple Ten Guarantee, they’ll monitor your system and be there to fix it should anything go wrong.

Solar is a Low-Risk Investment

Compared to other investments, solar is particularly low risk – especially given the potential returns it offers businesses. It’s a reliable technology with decades of proven success.

With a solar investment, you’re mostly banking on the following: electricity prices will continue to rise, your equipment will last, and the sun will keep shining.

If electricity prices stay stagnant, you won’t be losing money; you’ll just be saving less. However, it’s pretty safe to assume electricity will be more expensive when your system nears the end of its life in 25 or 30 years or more than today.

When it comes to your equipment working properly, as long as you go for quality solar panels and inverters that are protected by manufacturing warranties, you likely won’t have any issues.

In addition, unlike other types of equipment investments, solar will not raise your payroll or any other fixed costs, and its financial return is not dependent on economic cycles.

It’s Environmentally Friendly, and People Love That

Installing a solar system will have a real, measurable impact on the environment. You’ll be able to calculate how many trees you’re saving, how many barrels of oil you’re offsetting, and how many tons of CO2 you’re keeping out of the air.

As a society, we’re shifting increasingly towards an eco-friendly future, and customers and employees alike will appreciate that you’re taking steps to lessen your business’s carbon footprint. Going green can help your business right alongside helping the environment.

Disadvantages of Solar Energy for Businesses

Solar Requires an Upfront Investment

One of the biggest barriers to entry when it comes to installing solar is the upfront cost. While prices have come down substantially over the years, it’s still a significant investment to make.

A 100 kW system (which produces about enough electricity to offset a $1,200/month electric bill) can have an installation cost of around $238,600 before the tax incentives and around $114,147 after. That said, many commercial solar systems reach payback in a few short years and contribute a double-digit ROI.

Solar Panels Take Up Space

You’ll have to account for where the solar panels will be installed. Many businesses opt to install the panels on their roofs, turning an underused space into a money-making machine. On a roof, the panels will be out of the way of any business operations.

However, not all roofs are ideal for solar. If your roof doesn’t have ample sun exposure or cannot support the additional weight of the panels, you may want to find another solution. Ground mounts, while they do take up land, can be positioned in the optimal location for electricity generation.

Another option is installing a solar carport. Mounted above your parking lot, these systems will also increase the function of underused space. Your solar system will not only produce free electricity but also provide shelter for your employees’, visitors’, and customers’ cars.

A Solar System Won’t Generate Energy Without Sunshine

Sunshine is essential to a solar system. The more sunshine there is, the more money you’ll save. However, not every location is ideal for solar energy, from regional weather patterns to trees or buildings that cause shading.

Solar works best when it faces south, tilted at a degree specific to your location’s latitude, and free from any shading-creating obstructions. Should your building be surrounded by large trees that shade the roof throughout the day, solar may not be feasible unless you’re willing to eliminate those trees.

That said, you don’t need to live in Florida or Southern California for solar to make sense. A solar investment can thrive even in areas renowned for their snowiness and cloudiness. From Ohio to Upstate New York, we’ve seen businesses thrive with a solar investment.

Solar Panels May Impact Curb Appeal

Curb appeal can be important to many businesses. The look of your building may be a potential customer’s first impression of your business. It’s natural to want to put your best foot forward by creating an attractive, welcoming space.

Solar panels may not fit into the aesthetic of every building and business, though the return on your investment may be enough to convince you otherwise! That said, solar panel manufacturers hear this and have worked on a few different options to make their products more visually appealing, from frame type and color to panel type and size.

It May Not Offer the Best Return If You Plan on Moving Soon

Solar energy is a long-term investment. Your system can take a few years to generate enough electricity to fully pay for itself. But once it does, it generates pure savings, so you can keep that money right in your pocket or reinvest it elsewhere.

If you plan on moving your business to a different location a few years after installing your solar system, you may want to hold off until you’re settled in your new place. The longer you stay in your building to take advantage of that free electricity, the greater the system’s return for you.

Solar Won’t Provide Backup Power Without Batteries

When the power goes out and the grid goes down, your grid-tied solar system will stop providing power to your business. If it’s sunny, your panels will still be capable of producing electricity; however, for safety reasons, it’s required that your solar system shuts off until power is restored.

This means you won’t have access to electricity unless you invest in solar batteries. With a battery-backed solar system, your charged batteries can kick on when the grid goes down to provide power to your business until the grid comes back on. That said, batteries can be expensive to install and will decrease the financial return of your system.