As a farmer, it’s likely that you’ve been approached by solar companies offering to lease your land for the installation of solar panels. While these proposals may seem enticing at first, they often come with legal and tax complications, community opposition, and other unforeseen challenges.

On the other hand, you may have also been presented with the option of solar ownership, where you would purchase and own the solar system yourself. It’s important to carefully consider which of these solar options, if any, would be the best fit for you and your needs.

Continue reading to explore the details of both solar options and make an informed decision that aligns with your needs and goals.

What Are Solar Land Leases?

Solar land leases are agreements between a landowner and a solar developer. The solar developer leases the land to install photovoltaic (PV) solar arrays to generate electricity.

The electricity generated from these types of systems does not benefit the landowner. Instead, the benefit to the landowner comes from lease payments received from the solar developer for the use of the land.

For many crop farmers, solar land leases may seem like a lucrative option with offers close to double the return per acre than what growing crops would produce. If you don’t use a fair amount of electricity and don’t have a federal tax liability to offset, this may be a viable option for you. There are, however, several considerations that deserve discussion including land conservation, community opposition, utility infrastructure limitations, and the rollback of taxes.

In many areas, state legislatures are pushing to conserve farmland. As a result, regulations proposed or current should be researched and considered as you make your decision to lease your land for solar.

Your state legislatures may not be your only opposition; your neighbors will likely become obstructionists as well. We saw this first hand when a Seattle-based solar company came to Anne Arundel County, Maryland in June 2017 hoping to win over residents about installing three separate solar projects on farms in Southern Maryland. The community was united in their opposition to these projects and they expressed their desire to keep the area rural. If you are leaning towards a solar land lease, you should have a game plan to drive community support and get your neighbors on your side.

Your state legislatures may not be your only opposition; your neighbors will likely become obstructionists as well. We saw this first hand when a Seattle-based solar company came to Anne Arundel County, Maryland in June 2017 hoping to win over residents about installing three separate solar projects on farms in Southern Maryland. The community was united in their opposition to these projects and they expressed their desire to keep the area rural. If you are leaning towards a solar land lease, you should have a game plan to drive community support and get your neighbors on your side.

Once you have local government approval and your community on your side, your solar developer will need to work with your utility company to confirm that adequate utility infrastructure, particularly transformers and sub-stations are in place to support the proposed solar system. These challenges and costs should be the responsibility of the solar developer, but be aware of where new power lines, transformers, etc. will be placed on your property.

Another key consideration that could have a substantial financial impact is the rollback of taxes. Most land that is used for agricultural purposes is entitled to a tax reduction or exemption. Should you choose to lease your land for solar, that tax exemption or reduction could be rolled back for five years. This rollback of taxes has the potential to turn what appeared to be a worthwhile investment into a loss.

Finally, you may want to consider what happens at the end of the lease term. What happens to the equipment? Who removes it? What will your property look like? Who’s responsible for maintaining the land while it’s leased?

We suggest asking the developer for references who are under contract before signing on the dotted line. Here are a few good questions to ask other landowners:

- Was the project completed in the time allotted?

- Did they take care of your property?

- Are they paying as promised?

- Are they maintaining your land as promised?

- What are the end-of-term arrangements?

- Who will take care of removing the solar equipment at the end of the lease?

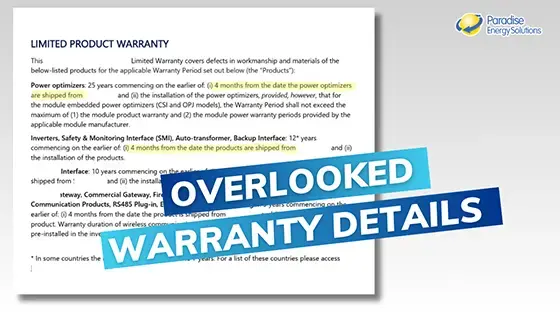

As you can see, solar land leases are complex instruments with many challenging variables. Make sure everything is in writing, and make sure that you understand the fine details. Always seek the advice of an attorney specializing in solar land leases when considering leasing your land for solar.

How Solar Ownership Is Different From Solar Land Leases

Solar ownership is when a farmer, business owner, or homeowner purchases a solar system with four primary goals in mind:

- To reduce and control their energy costs

- To reduce their federal tax liability

- To invest in an asset with above-average returns, and;

- To reduce their carbon footprint and protect the environment

With solar ownership, you have direct control over the electricity generated by your solar system. This means that you can use the electricity on-site, either directly or indirectly through programs like net metering or power purchase agreements.

Net metering allows you to send excess electricity back to the grid, earning credits that can be used when you need to draw electricity from the grid. Power purchase agreements involve selling the excess electricity generated by your solar system to a third party, providing you with additional income.

One of the major advantages of solar ownership is the long-term cost savings. Over a thirty-year period, the cost of electricity generated by your own solar system is significantly lower than purchasing electricity from your utility company. While there is an upfront investment to purchase and install the solar system, once it is paid for, you can enjoy decades of free electricity. This can result in substantial savings on your energy bills over time.

In addition to the cost reduction, solar ownership comes with attractive financial incentives. There is a 30% federal tax credit available to all solar owners, which can significantly reduce the initial investment cost. This tax credit can be used in the year of installation or carried backward or forward to cover previous or future tax liabilities. Businesses and farmers can also benefit from tax depreciation savings, further enhancing the financial advantages of solar ownership.

Furthermore, solar investments are known for their strong return on investment (ROI). Most commercial, agricultural, and residential solar projects have an average ROI ranging from 10% to 20%. These investments are relatively low-risk, providing a stable and profitable financial opportunity for those who choose solar ownership.

In conclusion, if you pay federal taxes and use a fair amount of electricity, solar ownership is a smart and straightforward investment. Not only does it allow you to significantly reduce or eliminate your energy costs, but it also offers attractive financial incentives and a positive impact on the environment. By taking control of your energy production, you can secure long-term savings and contribute to a sustainable future.

Want to learn more?

Going solar is a big decision, but we are here to help you decide if it’s the right investment for you. If you would like to learn more just let us know and we will help you get started.