Cash-Flow Positive from Day One

The RISE PA grant and tax incentives cover most upfront costs, making solar a low-risk way to reduce a significant expense and protect your bottom line.Your Electric Bills Keep Rising. Your Taxes Keep Climbing. Solar Gives You Control Over Both.

But This Window of Opportunity is Closing Fast.

The RISE PA grant offers massive savings—but it won’t last forever. Funding is limited, and once it’s gone, it’s gone—the first application deadline is August 15th for small-scale awards, and August 29th for medium and large-scale awards.

At the same time, the federal solar tax credit is on the chopping block. If Congress passes the proposed legislation as it currently stands, commercial projects will have just 60 calendar days after the bill is signed into law to begin construction or to safe harbor the project to lock in their tax savings.

If you wait too long, you could miss out on both programs, and that would mean you’re leaving hundreds of thousands of dollars on the table.

How The Rise PA Grant Can Save You Up To 50% On Your Solar Investment.

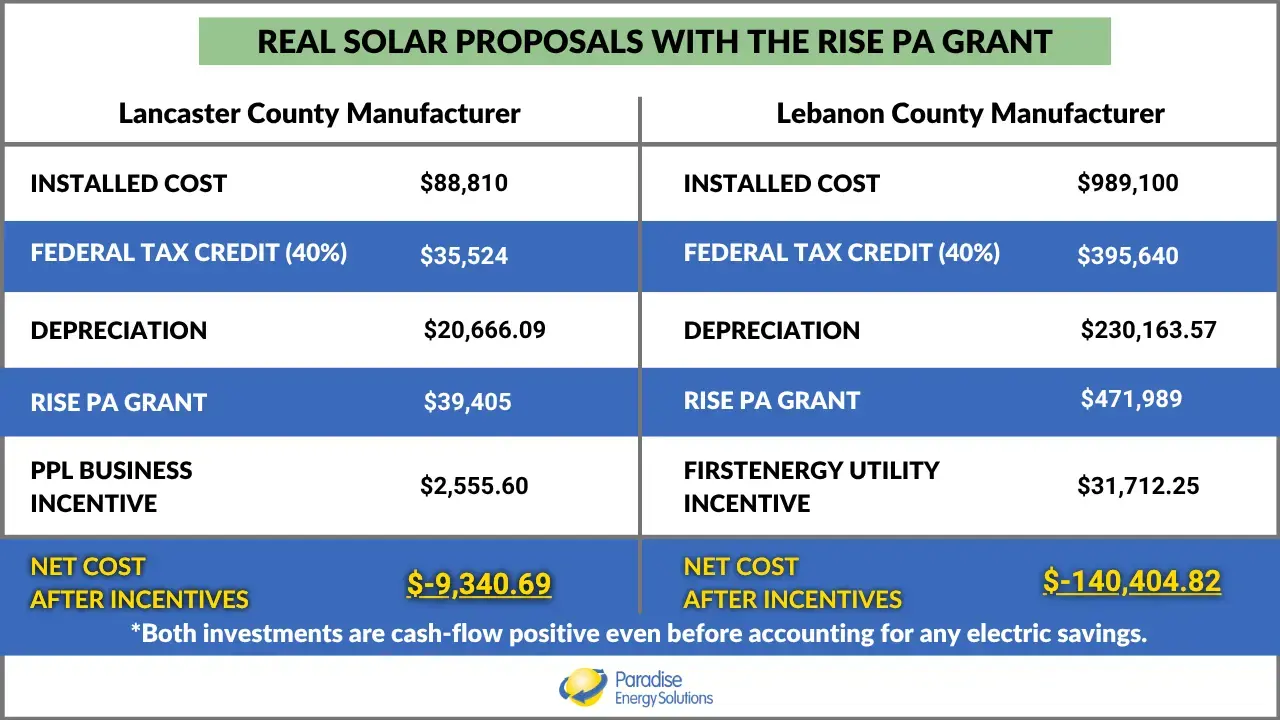

Real Examples of What a Solar Investment Could Look Like For Your Business.

Who Qualifies?

Steps to protecting your bottom line

1: Request your custom quote

2: Lock in Your Installation Slot

3: Installation Begins

See Why People Like You Choose Paradise Energy

The Paradise Energy Difference

We’re Solar Experts

We Invest In Training

We’re A One-Stop Provider

Start Right Here To Secure Your Savings.

Frequently Asked Questions

What's needed to complete your Rise PA grant application?

Here’s what you’ll need to complete your Rise PA grant application: It might sound like a lot, but don’t worry. We have an experienced in-house grant writing team that will help you every step of the process.

When is the deadline to apply for the Rise PA grant?

The first application deadline is August 15, 2025, for small-scale awards and August 29, 2025, for medium and large-scale awards. But don’t worry if you miss it. Additional competitive rounds will be held every four months through August 2028, or until the funds are exhausted.

Will I be required to complete the grant paperwork and application?

If your project is under $1 million, our team will complete and submit the grant application for you. For larger projects, we’ll connect you with a trusted partner to support your application. Either way, you’ll get expert support from us, making the process as easy on you as possible.

Can I combine the Rise PA grant fund with other incentives?

Yes, the Rise PA Grant can be used in conjunction with other incentives, like the federal tax credit, depreciation, and utility grants.

What’s the maximum amount I can get from the RISE PA grant?

Projects under $1 million can receive up to 50% of the total installation costs (max $500,000). Projects over $1 million can receive up to 30% (max $20 million).