Don’t Lose Thousands in Tax Savings

Act Now Before Your Tax Credit Is GoneYour Electric Bills Keep Rising. Your Taxes Keep Climbing. Solar Gives You Control Over Both.

The Federal Solar Tax Credit is Coming to an End.

The Big Beautiful Bill is ending solar tax credits. While the credit is available until 2027, this year (2025) will be your best opportunity to secure these tax savings.

Foreign Entity of Concern (FEOC) requirements begin in 2026. These requirements will make obtaining your tax credit much more challenging.

Commercial projects must be safe-harbored by December 31, 2025, to qualify for the federal tax credit under the current rules.

Wait until 2026, and you could lose the tax credit altogether or, at best, face higher installation costs and supply chain challenges.

Secure Your Tax Credit Now Before FEOC Rules Take Effect

Safe Harboring lets you lock in today’s federal solar tax credit before new FEOC (Foreign Entity of Concern) restrictions take effect in 2026. By taking action now, you can “beat the deadline” and protect your project’s eligibility for up to four years.

There are two IRS-approved ways to qualify for Safe Harbor: begin construction before the deadline (Physical Work Test) or invest at least 5% of your total project cost in qualified hardware before December 31, 2025, and take delivery or expect delivery within 105 days (the 5% Rule).

Paradise Energy recommends a 7% deposit to account for potential cost increases and ensure your Safe Harbor remains valid.

Secure Your Solar Tax Credits – Starting Right Here

Step 1 to securing your tax savings is completing the form below. After submitting this form, your local solar consultant will contact you within 24-48 business hours, but often sooner.

Here’s what to expect:

- An informative conversation to address your questions, learn your solar goals, plan a site visit, and collect details for an accurate quote.

- A detailed custom quote with a preliminary system design, full cost breakdown, available incentives, and a 30-year cash flow showing exactly what you’re investing in.

See Why People Like You Choose Paradise Energy

The steps to protecting your bottom line

1: Request your site visit

Your local Solar Consultant will visit your site to understand your goals, gather key details, and answer your questions. Within 2–3 business days, you’ll have a detailed custom solar quote with all the critical information you need to make an informed investment decision.

2: Safe Harboring, Design, Permitting, & Installation

3: Your Savings Begin

Now comes the best part. Your solar investment is producing power, lowering costs, and helping you Save With Every Sunrise.

Frequently Asked Questions

What other incentives are available?

The tax credits and depreciation (commercial only) are the primary benefits available to help offset the installation cost. However, several state and utility company grants are available depending on your location. Your Paradise Energy Solar Consultant will guide you to all available incentives.

Can I still go solar after the deadline?

Yes, but you’ll lose thousands in tax credits. Solar will still save you money on electricity, but losing the tax credit will drastically impact your investment payback.

How much can I really save with the solar tax credit?

For homeowners, the federal tax credit covers 30% of the total cost of the system. On an average residential system, this would equate to $7,000 to $15,000 in tax savings. The benefits are a bit sweeter for commercial systems with a tax credit ranging from 30% to 50%. This is significant savings that would otherwise […]

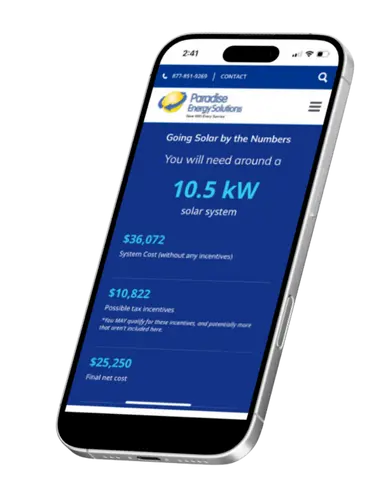

Quickly Estimate Your Solar Price, ROI, and Savings

Wondering what solar really costs and how quickly it pays back? Our free Solar Estimator tool gives you instant answers. In just a few clicks, you’ll see a ballpark system cost, estimated savings, ROI, and payback period. No salesperson required.