Since 2005, the Solar Investment Tax Credit (ITC) has been a valuable incentive for individuals and businesses interested in investing in solar energy.

However, with the passage of President Trump’s Big Beautiful Bill, these valuable solar tax credits are set to expire for commercial Solar, and have already come to an end for residential solar.

We’re here to unravel the intricacies and help you understand how to benefit from the tax incentives while your window of opportunity is still open.

The Residential Federal Solar Tax Credit

As of December 31, 2025, the Residential Investment Tax Credit (Section 25D) has expired and is no longer available to homeowners. At this time, the Commercial Investment Tax Credit is the only remaining federal tax incentive available for solar energy investments.

The Commercial Federal Solar Tax Credit

Here’s what you need to know about the commercial solar tax credit (Section 48):

- The full tax credit is available until the end of 2027.

- Foreign Entities of Concern (FEOC) requirements now apply to all commercial solar projects. To qualify for tax credits under Sections 45Y or 48E, at least 40% of the value of manufactured products used in a solar project must come from manufacturers that are not classified as prohibited foreign entities, including China, Iran, Russia, and North Korea. While these requirements are now in effect, the federal government has not yet released full guidance on how they will be defined, verified, or enforced.

- Commercial solar projects must be safe harbored by July 3, 2026, to preserve eligibility and extend the installation window by up to four years. Projects that are not safe harbored must be fully installed by December 31, 2027, to qualify for the federal tax credit.

- For projects 1.5 MW AC and smaller, safe harboring (start of construction) means either beginning physical work or “safe harboring” by spending 5% of your project costs, typically through the purchase of equipment. Paradise Energy recommends a 7% upfront investment to help safeguard your project against future price increases that could otherwise reduce your safe harbor amount below the required 5% threshold.

- Projects larger than 1.5 MW AC may no longer use the safe harbor option. They must begin physical work to qualify.

- Once safe-harborred, you’ll have until December 31, 2030, to complete the installation and still claim the credit.

How Much Is The Commercial Solar Tax Credit?

While the Big Beautiful Bill changed the availability timeframe and some qualifying requirements, the available amounts remain the same for the duration of the tax credit.

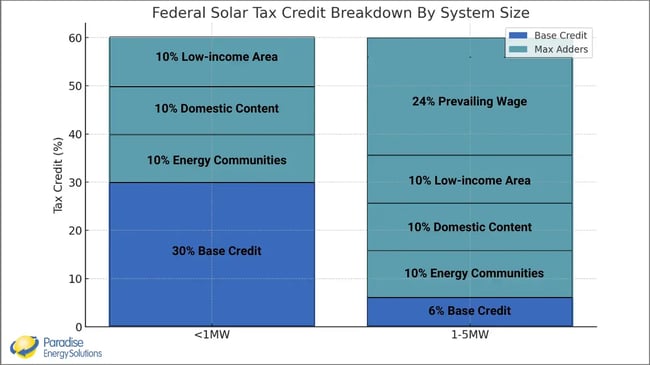

Commercial Solar Systems Under 1 Megawatt (MW) AC Power

Commercial entities installing a solar system with a capacity of less than 1 MW of AC power are eligible for a base tax credit of 30%. This credit can increase to as much as 70% if the system qualifies for three adders, covering 30-70% of the total installation cost.

Commercial solar installations may qualify for up to three adders if specific conditions are met. While it is unlikely you will qualify for all three, we provide more detailed information on each incentive later in this blog.

- Energy Communities (+10% tax credit)

- Domestic Content (+10% tax credit)

- Low-Income Areas (+10 – 20% tax credit)

Systems Over 1 Megawatt (MW) AC Power (Solar Developers, Utilities, XL Industrial)

The tax credit for solar systems over 1 MW AC power begins at 6% across the board but can increase to 70% if certain conditions are met. This includes the same three adders as smaller commercial systems, in addition to a prevailing wage bonus:

- Prevailing Wage: The 6% rate can increase to 30% if the project meets prevailing wage and apprenticeship requirements.

- Energy Communities (+10% tax credit)

- Domestic Content (+10% tax credit)

- Low-Income Area (+10 – 20% tax credit)

These large systems can also choose a production tax credit (PTC) over the ITC. This credits system owners based on the amount of electricity the system produces. The current rate is $0.026/kWh, but it will increase with inflation. Adders for low-income solar installations apply only to the solar ITC.

How to Qualify for the Solar Tax Credit Adders

A series of commercial tax credit adders can boost the tax credit amount by 10% each. Commercial systems under and over 1 MW may qualify for these adders, but residential systems will not. Below are the additional requirements commercial systems must meet to qualify for the energy communities adder, domestic content adder, and low-income adder.

Energy Communities 10% Tax Credit Adder

This adder aims to accelerate the adoption of renewable energy in key areas of the country. Qualifying systems can add 10% onto their tax credit if their system is located in or on one of the following:

- A brownfield site as defined by CERCLA.

- A fossil-fuel closure census tract (an area with a post-1999 coal mine closure or an area with a post-2009 coal-fired electric generating unit closure)

- Metropolitan Statistical Area (MSA) with an economic dependence on coal, oil, or natural gas. These areas will change every year. To qualify, the area must have:

- 0.17%+ employment or 25%+ local tax revenues related to the extraction, processing, transport, or storage of coal, oil, or natural gas, and

- A higher-than-average unemployment rate based on last year’s national average.

Use this map to determine if you’re in an area that qualifies.

Domestic Content 10% Tax Credit Adder

To support U.S. manufacturing, commercial solar projects can qualify for an additional 10% Investment Tax Credit (ITC) bonus if they meet domestic content requirements. While the guidelines continue to evolve, recent updates provide more clarity on how businesses can qualify.

Note: these requirements are not yet final and will likely change. We recommend confirming your project details with your accountant.

To receive the 10% tax credit bonus, solar projects must meet two key requirements:

- Steel and Iron Rule – 100% of the steel and iron used in your project must be made in the U.S. If this isn’t met, the project won’t qualify.

- Manufactured Products Rule – At least 45% of the total cost of the manufactured components (such as solar panels, inverters, and racking) must be made in the U.S. This requirement will increase to 55% in 2027.

The government recently updated the domestic content rules, making a few key changes:

- Solar Canopies & Carports Qualify – These now fall under ground-mounted solar structures, making it easier to meet the 40% requirement.

- More Weight Given to Solar Panels – The percentage of U.S.-made content in solar modules now plays a bigger role. Some systems may qualify using a mix of U.S.-made and imported modules.

- Less Weight Given to Inverters & Racking – Previously, inverters and racking counted for more toward the 45% requirement. Now, they play a smaller role, meaning more emphasis is on U.S.-made solar panels.

- Clarification on Fasteners – Only certain fasteners, like module clamps and rail splices, count toward domestic content. Roof attachments and tilt legs are not required to be U.S.-made.

What This Means for Your Project

- Ground-mount systems will likely have no issue meeting the 45% domestic content requirement, even with a mix of U.S. and non-U.S. solar panels.

- Roof-mounted systems can still qualify, but they will likely require additional U.S.-made module components to exceed 45%.

- Safe Harboring Is No Longer Necessary – Initially, companies were considering locking in older rules. However, since the 45% rule remains unchanged, there’s no need to rush into pre-purchasing materials.

If a business seeking to satisfy the domestic content adder experiences a project cost increase by more than 25% or a product is unavailable, it may qualify for a waiver. However, the process of claiming this waiver is undefined at this time.

Low-Income Communities 10% Tax Credit Adder

The tax credit adder for low-income communities seeks to bring more renewable energy to areas that may be underserved, marginalized, or environmentally overburdened. Note that this does not include individual residences; it applies only to multi-family housing. Qualifying projects can receive an additional 10%-20% on their solar investment tax credit if they fall within one of the following four categories:

- Low-income communities (eligible for a 10% adder) are defined as:

- The poverty rate is at least 20%

- For non-metropolitan areas, the median income does not exceed 80% of the state’s median family income

- For metropolitan areas, the median income does not exceed 80% of the state’s median family income or the metropolitan area’s median family income

- Indian land (eligible for a 10% adder) is defined by the Energy Policy Act of 1992 (25 U.S.C. 3501(2).

- Qualified low-income residential building projects (eligible for a 20% adder) are defined as:

- Residential rental building participating in a covered housing program

- USDA housing assistance program under Title V or the Housing Act of 1949

- Housing program administered by a Tribally designated housing entity of the Native American Housing Assistance and Self-Determination Act of 1996

- The financial benefit of the electricity produced is allocated equitably among the residents

- Qualified low-income economic benefit project (eligible for a 20% adder) must provide at least 50% of the financial benefits of the electricity produced to:

- Households with incomes less than 200% of the poverty line

- Households making less than 80% of the area’s median gross income

To qualify, the system must be smaller than 5 MW AC. Low income must be documented with pay stubs, tax records, or social assistance programs such as SNAP and SSI.

A project may be disqualified if it is placed in service before the adder is granted or if it is not placed in service within four years of the award date. Additionally, disqualification may occur if the system fails to meet the financial benefits requirement or if the system size is reduced by 2kW or 25%, whichever is greater.

The best way to ensure your project qualifies is to consult your tax expert or accountant.

This adder is capped at 1.8 GW of solar per year, meaning availability ceases once the annual allocation is met. No other adder has a cap.

Commercial Tax Credit Recapture Rules

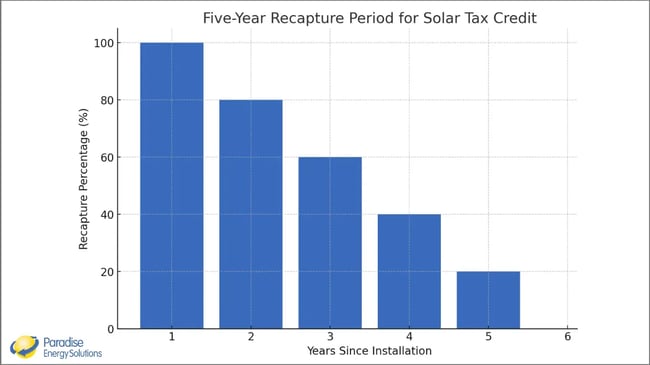

It’s important to note that the commercial solar tax credit includes recapture rules, which may require you to repay a portion of the credit if your solar system is sold, destroyed, or no longer used in a qualifying manner within five years.

The recapture rules for the commercial solar tax credit apply during the first five years after your solar system is placed into service. In the first year, 100% of the credit is subject to recapture if the system no longer qualifies. This percentage decreases by 20% each year, reaching zero after year five. If the system becomes disqualified during this period, you’ll be required to repay the unvested portion of the credit in the year the event occurs.

Recapture can be triggered by several events, such as the system no longer being used as a qualified energy facility, being permanently destroyed without repair or replacement, or undergoing a change in ownership during the recapture period. If any of these events occur, the IRS will reclaim the unvested portion of your solar tax credit, resulting in an increased tax bill for the affected year.

What If You Don’t Owe Enough Taxes to Use The Full Solar Tax Credit?

If you have a tax liability, your solar tax credit must be applied to offset your owed taxes in the year your solar system is energized. However, there’s good news for those with limited tax liability who can’t use their entire credit in the first year.

The commercial solar tax credit offers great flexibility. Businesses can apply the credit to recover taxes paid in the previous three years and carry the remaining balance forward for up to 22 years, ensuring no portion of the credit goes to waste.

The three-year carryback for unused tax credits is authorized under IRC § 39(a)(4), which expands the normal carryback rule in § 39(a)(1) for applicable clean-energy credits, including the solar ITC under section 48.

Direct Pay For Nonprofits and Other Tax-Exempt Organizations

Nonprofits and state and local governments can use the direct pay option (also known as elective pay) for all or part of the solar tax credit. This makes the tax credit available to nearly every entity.

As with commercial solar tax credits, the direct pay option is only available through December 31, 2027. If your system cannot be installed by that date, safe harboring may still preserve your eligibility. To qualify, your project must be safe-harbored by July 3, 2026, which extends the allowable installation timeline through 2030, providing additional flexibility without forfeiting the incentive.

Here’s who may qualify

- Nonprofits (like 501C)

- Municipal & state entities

- Rural electric co-op

- TVA

- Indian Tribal governments

- Alaska Native Corps, etc.

Here are the conditions:

- For systems under 1 MW, tax-exempt entities will receive 100% of the 30% tax credit.

- If the domestic manufacturing requirements are not met on 1 MW+ systems, they’ll receive 20% in 2026.

- These organizations are eligible for the other 10-20% adders if they meet those specific requirements. However, if they do qualify, you can only collect funds for the net system cost after deducting the ITC and the adders, which would likely be less than 70% of the total cost.

Filing for the direct payment must be completed at the end of the following tax deadline, which is in May of the following year for 501(c) non-profits. Receiving the direct payment could take up to one year or more.

Additionally, the source of funds is important when claiming direct pay. If an “applicable entity” contributes more than 70% of the system’s cost through special funding, the excess will reduce the direct pay amount.

A waiver may be granted if costs increase more than 25% due to the domestic content requirement or if the products are unavailable.

Is There A Tax Credit Available For Battery Storage Systems?

Previously, the ITC was limited to battery backup systems installed within one year of a solar energy system. However, under the IRA, you can now fully benefit from the tax credit when installing a battery system, regardless of whether or when you install solar. This means that you can utilize the federal tax credit even if you installed solar years ago or haven’t installed it at all.

To qualify, energy storage systems must have a capacity of over 3 kWh, and eligibility is also tied to the U.S. Department of Treasury’s energy reduction goal.

However, keep in mind that this incentive will also end when the rest of the tax credits expire.

Common Questions About The Federal Solar Tax Credit

Can I claim the tax credit on leased or financed solar systems?

The federal solar tax credit can only be claimed by the system owner. For leased systems, this means the lessor, not the lessee. The system owner may also claim the credit even if the system is financed.

How Does The IRS Verify Solar Tax Credit Eligibility?

The IRS verifies solar tax credit eligibility by assessing whether taxpayers meet specific criteria established under federal law. The solar energy system must be installed at a qualifying property, such as a residential or commercial building, and used to generate electricity.

It is important to note that the taxpayer must own the system to claim the credit; lessees, such as those in lease agreements or power purchase agreements (PPAs), are not eligible. However, if the system is financed, the taxpayer can still claim the credit as long as they retain ownership.

Verification starts with the documentation submitted when claiming the credit. Homeowners must complete and file IRS Form 5695, Residential Energy Credits, along with their tax return. Businesses claim the tax credit using IRS Form 3468. The individual partner/shareholder then files Form 3468 (duplication of what the business filed, but is reporting their share), and Form 3800.”

These forms require information such as the total cost of the system, the installation date, and any applicable deductions or adjustments, like state rebates or incentives. Supporting documentation, including contracts, invoices, and proof of payment, is crucial to substantiate the claim and should be retained for potential IRS review.

The IRS may also confirm that the installation occurred during the tax year for which the credit is claimed and that the system is located on a property in the United States. Additionally, if taxpayers apply for credits after receiving other incentives, such as state or local grants, these must be deducted from the claimed federal credit or claimed as income.

To prevent fraud, the IRS may audit claims or request further documentation to confirm eligibility. This could include reviewing ownership agreements, installation timelines, and compliance with federal guidelines. Accurate record-keeping and adherence to IRS requirements are critical for taxpayers to successfully claim and retain the solar tax credit. By carefully verifying each claim, the IRS ensures that this tax benefit is used appropriately to promote renewable energy adoption.

The new IRS forms do provide the IRS with more information, especially related to the bonus adders.

How Does the Solar Tax Credit Work If I Don’t Owe Enough Taxes?

The federal solar tax credit is intended to reduce your tax liability, but what if you don’t owe enough taxes to use the entire credit in a single year? Fortunately, there are flexible solutions for businesses to help them maximize the benefits of the credit.

Businesses can apply the credit retroactively to recoup taxes paid in the previous three years or carry it forward for up to 22 years until it’s fully utilized.

Additionally, businesses can transfer the credit to a third party. While this typically results in receiving less than 100% of the credit’s value, it can be a practical solution in some situations. However, strict rules must be followed to complete a transfer successfully.

Are You Ready to Capitalize on the Tax Savings from Solar Energy?

Are you ready to see what a solar investment could do for you? The first step is to speak with one of our local solar consultants. They will answer all your questions and help you investigate what a solar investment would look like for you. Time is running out on your tax credit. Get started now before it’s too late.

If you’re not ready to speak with our team, you can use our solar ROI calculator and visit our solar learning center to continue to learn about your solar energy investment.