Solar Energy Installations That Save You Money

Protect your budget.

You work too hard not to.

With solar energy, you’ll save money and protect your budget from the soaring rates we’re all facing. You will be in control. Gain peace of mind over your budget. Stop wasting your hard-earned money.

Commercial

Farms

Residential

Non Profit

Commercial Solar Panel Installations

Immediately add savings to your bottom line and be in control of a fixed cost with a solar energy investment.

Control A Fixed Cost

No more worrying about unpredictable rate increases. You’re in control.

Create Short and Long-term Savings

Pay fewer taxes now and reap the benefit of electric savings for the next 25+ years

Invest In A Quick Return

Recoup up to 90% of your installation cost in year one through tax savings, grants, and electric savings.

Solar Panel Installations for Farmers

Increase your farm's profitability while eliminating the burden of an unpredictable electric bill.

Protect Your Bottom Line

Turn your electric bill into consistent and predictable savings. Say goodbye to the stress of worrying about rising electricity rates. You’ll be calling the shots.

Invest In Your Future

Quickly receive up to 90% of your solar investment back in year one through tax savings, grants, and electric savings. That’s money to reinvest in the future of your farm.

Be A Difference-Maker

Invest in the financial and environmental sustainability of your farm.

Residential Solar Panel Installations

Stop renting your electricity. Protect your budget.

Keep Your Hard-earned Money

Pay fewer taxes and reduce your electric bill – that’s immediate and long-term savings.

Invest In Your Home

Studies show that owning a solar system increases the value of your home by over $15,000. Who doesn’t want to buy a home without an electric bill?

Be Part of the Solution

Make a difference for your budget and the world around you.

Solar Panel Installations for Nonprofits

Turn a fixed cost into predictable and sustainable savings

Reduce A Fixed Cost

Reduce your electric bill and add savings to your bottom line – no more worrying about rising rates.

Quickly Recover Your Investment

With the new direct pay tax incentive and electric savings, you'll quickly free up funds to allocate towards what truly matters - fulfilling your organization's mission.

Grow Your Impact

Be a good financial and environmental steward for your community.

Switch to solar & save

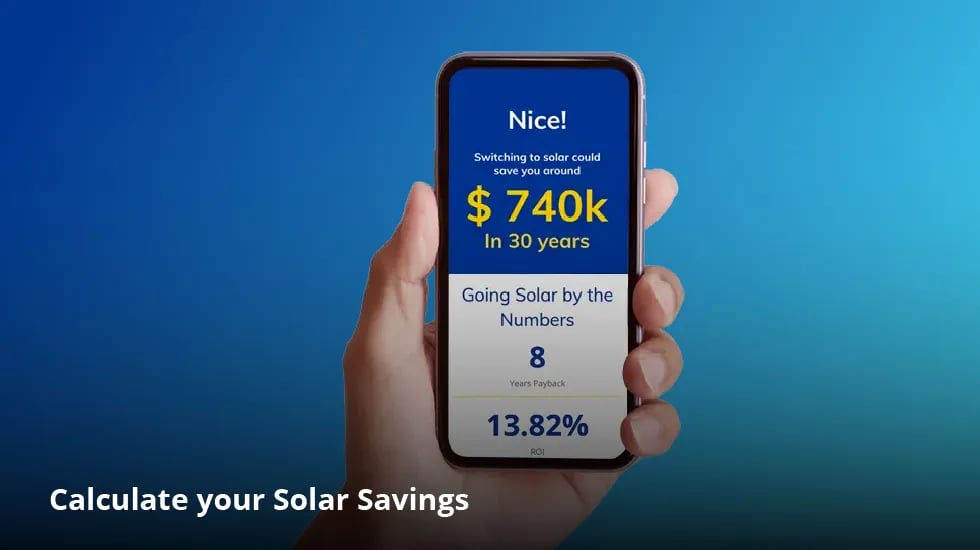

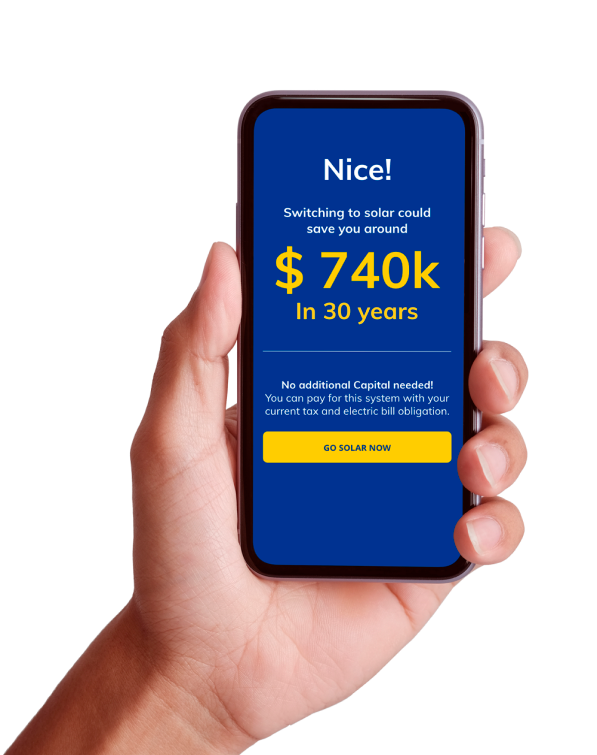

Use our solar calculator to see how solar can help you. We'll provide you with:

- A 30-year Cost Breakdown

- Cumulative Cash Flow

- Payback, ROI and Environmental Savings

Here's what our customers say

Commercial

Agricultural

Residential

Non profit

Goodville Insurance - Phil Shirk

CFO | New Holland, PA

Hardware Store - David Kenney

Owner | Mardela Springs, MD

nuCamp RV - Jesse Mullet

President | Sugarcreek, OH

How Sweet It Is - Brent Malone

Owner | Eden, MD

G&G Grain - Zac Guthrie

Owner | Frazeysbug, OH

Kurtz Family Farm - James & Josh Kurtz

Owners | Snow Hill, MD

Krueger Farms - Carl Krueger

Owner | Berlin Heights, OH

Klock Family Dairy Farm - Lee Klock

Owner | La Fargeville, NY

Guy Family - Warner & Amy Guy

Dover, OH

Will Ruhland

Delmar, DE

Dennis Rupert

Mentor on the lake, Oh

James & Jane Todd

Wooster, OH

CSAAC - Craig PardiniL

Director of Infastruction Operations | Montgomery Village, MD

Salisbury Christian School - Ross Kaelin

Director of Facilities/Assistant Principle | Salisbury, MD

Harrisonburg Mennonite Church | Steve Pardini

Member of the Purchasing Committee | Harrisonburg, VA

MennoHaven Retirement Community - Chuck Nelson

Chief Development Officer | Chambersburg, PA

We've helped hundreds like you

Click on the logo to view pictures of these commercial solar installations or

Investing in solar is simple

Our process

We understand solar is a big investment. That’s why we’re committed to being your long-term solar energy partner.

Request your custom quote

Have your system installed

Start saving more of your money

Interested in joining the exciting and growing field of solar technology?

Over 100 solar experts

Ready to Serve You

We’re a family-owned, full-service solar energy company that will take care of the entire process. We install solar panel systems, EV chargers, and energy storage solutions and have an in-house solar maintenance & service team. Our industry-leading Triple Ten Guarantee provides an added layer of security for your investment.

Culture

Locations

Have questions? Well, we’ve got answers.

Who is Paradise Energy Solutions?

While solar energy is what we do, our team is what makes us stand out from the rest.

From the four brothers who started this company to our 100+ other team members, we’re here to help you make the best investment for your business, farm, and home - even if that means not going solar.

How much do solar panels cost?

An average monthly electric bill of $120 will need a 10 kW solar system in most cases. This will cost roughly $38,960 before incentives and $27,272 after the incentives are used. A $600 average monthly electric bill will need a 50 kW solar system. A 50 kW will cost roughly $147,500 before incentives and $66,803 after all the incentives are used.

View this blog to learn more about the cost of solar. You can also request a free custom quote to get exact numbers for a system that best fits your needs.

How much maintenance or upkeep is required?

Plus, if something goes wrong, there is a good chance it will be under warranty. Your panels and inverters come with lengthy warranties from the manufacturers. Paradise Energy adds an additional layer of security with our Triple Ten Guarantee. This guarantees the production and workmanship for the first 10 years.

Here's more on solar panel maintenance.

How long do solar panels last?

Learn more about the lifespan of solar panels.

What warranties are included with a solar system?

Solar panels also come with a product warranty. These range from 12 to 25 years in length.

Inverters come with a warranty of 12 to 25 years depending on the brand and type.

In addition to manufacturer warranties, Paradise Energy provides an added layer of security with our Triple Ten Guarantee. This guarantees the production of the system for the first 10 years. It also covers workmanship issues.

Visit our product warranties blog to learn more.

Can I make money selling solar energy?

Many utility companies will compensate you with electricity credits which will be used to offset the electricity you pull from the grid.

Net metering regulations vary by location, so be sure to check the rules in your local area.

Visit our net metering blog to learn more.

What are Solar Renewable Energy Credits (SRECs)?

Solar system owners will receive 1 SREC for every 1,000 kilowatt-hours (kWh) of solar energy produced by their system. Those credits are then sold in an open market - helping to generate passive income.

Visit our SREC blog to learn more and to see how much they are selling for.

Get honest answers to all your solar questions

This free guide (2,000+ downloads) will save you a ton of research time. You’ll get an honest, up-to-date comprehensive look at all things solar.

Download now to be on your way to a successful solar investment.

Explore Our Solar Energy Resources & Tools

Blog

Solar savings calculator

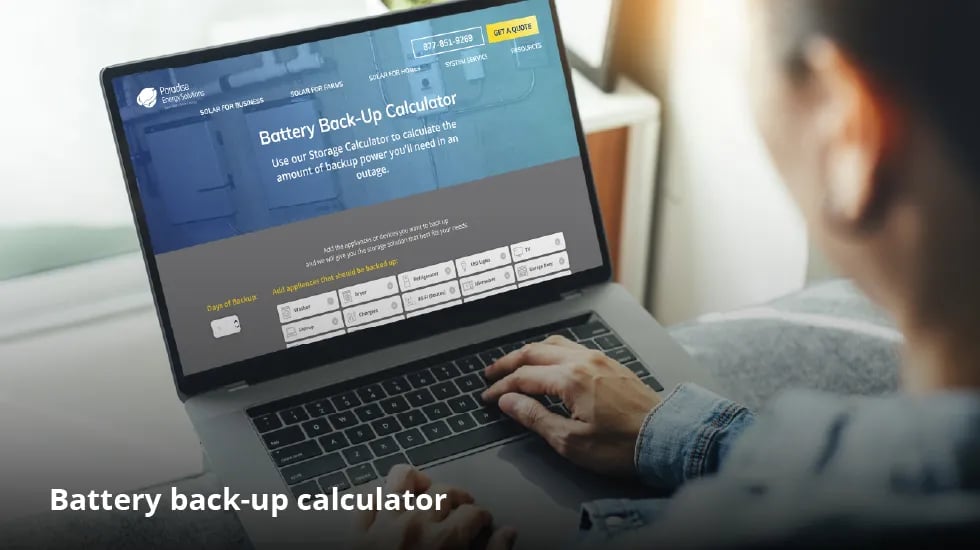

Battery calculator

Solar 101

Project gallery

Paradise Energy Among Top Solar Contractors in the US

Solar Power World, the leader in news and information for the solar industry, releases an annual...

How to Compare Solar Panel Quotes

Are you considering installing solar panels for your home or business? It's a smart move toward...

Top 10 Questions to Ask Your Solar Salesperson | Paradise Energy

Are you a homeowner or business leader looking to invest in a solar energy system but feel...