Discovering the true cost of commercial solar panels is the vital first step for business leaders who want to take control of a fixed cost - their electric bill. Understanding the factors that impact solar installation costs helps you make informed decisions and maximize the benefits of solar energy for your business.

The cost of commercial solar panels depends on various factors. The size and complexity of the installation, equipment quality, and specific business requirements all play a role in determining the overall cost. Government incentives, financing options, and maintenance expenses should also be considered.

Below, we provide the factors that impact the installation cost, available incentives, and a breakdown of the average cost of commercial solar panels (with real numbers).

- Factors That Impact The Installation Cost

- The Available Incentives

- Commercial Solar Costs

- How solar will help your business

The Factors That Impact The Commercial Solar Panel Installation Cost

The size of the solar system you choose to install is the primary determinant of the average cost of commercial solar panels. When it comes to commercial solar panels, size matters. The bigger the system, the more you'll have to invest. However, there's a silver lining - the cost per watt actually decreases for larger systems. This is because certain expenses, such as permitting, remain relatively constant regardless of system size. So, while the overall cost may be higher, the cost efficiency is in your favor.

When it comes to commercial solar panels, size matters. The bigger the system, the more you'll have to invest. However, there's a silver lining - the cost per watt actually decreases for larger systems. This is because certain expenses, such as permitting, remain relatively constant regardless of system size. So, while the overall cost may be higher, the cost efficiency is in your favor.

In many regions, the size of the solar system that businesses can install is limited. It is common for businesses to aim to offset as close to 100% of their electricity usage as possible, but not all businesses have the roof capacity or ground space to do so.

Several other factors can influence the cost of a commercial solar panel installation. These factors include:

- The type and brand of equipment you install

- Whether your system is a roof mount, ground mount, or carport

- If installed on a roof, the type of material the roof is made of - standing seam metal vs. a flat rubber surface

- The roof configuration

- The distance from the solar system to the interconnection point

- How much shade falls on the solar panels

- Interconnection costs

- Local governing regulations

What Incentives Are Available for Commercial Solar Panel Installations

Many businesses can recoup a significant portion of their solar installation costs within the first few years. Several readily accessible incentives expedite the return on investment for businesses. These include:

- The Solar Investment Tax Credit: If you install a system under the size of 1 MW, the federal tax credit returns 30% of the system’s installation cost to you in the form of a federal tax credit. Additionally, there are three 10% adders available that could drive up the tax credit even more. These additional adders are available for projects that satisfy the requirements for domestic content usage, and the projects must be situated in either a low-income community or an energy community.

- Accelerate Depreciation: With bonus depreciation on your solar equipment, you can choose to accelerate 60% of the tax savings from the depreciation of your solar system to the first year it’s placed into service, which further frontloads the investment. The remaining 20% will follow the 5-year MACRS schedule. State-level depreciation follows the 5-year MACRS schedule.

- Energy Credits: If you are the owner of a solar system, you may be able to make extra money with the clean electricity you generate. Solar renewable energy credits (SRECs) are awarded for every one-megawatt hour generated. These credits can be purchased by organizations that need to meet a specific clean energy target. These credits’ value is market-based, meaning the higher the demand the higher their price will be.

- USDA Reap Grant: The USDA grant is available to qualifying rural small businesses to help fund energy-efficiency improvements and renewable energy projects. Getting one of these grants is significant, with it covering up to 50% of the installation cost. However, the applications for the 50% grant will only be accepted through September 2024 or when all the available funds are dispersed.

- Local Government and Utility Company Incentives: Additional local incentives are available in some areas. New York, for example, has an NYSERDA Grant, a state tax credit, and a grant from National Grid.

Here's A Breakdown of Commercial Solar System Costs

Because a system's size impacts the average cost of a solar installation, we used that to create general price estimates for a roof-mounted commercial solar system. On average, businesses can anticipate an initial investment ranging from $140,000 to $500,000+ for their solar system, taking into account the system size and excluding any available incentives.

| Average Monthly Electric Bill | System Size (kW) | Total Installed Cost Before Incentives | Cost After Incentives |

| $600 | 50 kW | $141,700 | $67,790 |

| $1,200 | 100 kW | $238,600 | $114,147 |

| $2,400 | 200 kW | $430,600 | $206,001 |

Remember that various financing options are available for businesses investing in solar panels. Those options include outright cash purchases, solar loans, solar leases, and Power Purchase Agreements. Here's a guide to help you select the best commercial solar financing options.

Unleashing the Power of Solar Panels for Your Businesses

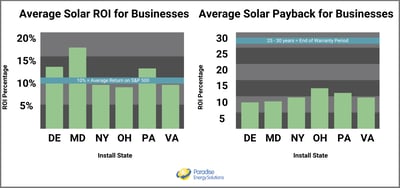

Investing in a solar energy system is a strategic business move that requires careful consideration. It's essential to evaluate whether the return on investment outweighs the initial costs and aligns with the best interests of your business. While the initial installation cost may seem daunting, it’s important to look beyond the upfront expense and consider the long-term benefits for your business.

The Financial Benefits of Commercial Solar

Although solar energy systems may appear costly upfront, the return on investment can greatly surpass the initial expense. An investment in solar will pay for itself with the free electricity it generates for your business. Instead of shelling out hundreds or thousands of dollars each month to the utility company, your system's savings go towards paying for itself.

An investment in solar will pay for itself with the free electricity it generates for your business. Instead of shelling out hundreds or thousands of dollars each month to the utility company, your system's savings go towards paying for itself.

Additionally, there are substantial tax advantages that can assist your business in reducing its tax burden.

The payback period for a business’s solar system will vary. Many businesses reach payback between six to ten years, leaving a large portion of the solar system’s 25+ year lifespan left to produce 100% free electricity.

The Environmental Benefits

Reducing a monthly fixed cost isn’t the only benefit of solar power.

Reducing a monthly fixed cost isn’t the only benefit of solar power.

Solar electricity is an emissions-free energy source, replacing traditional fuels that emit billions of tons of carbon into the air. One business’s solar system can dramatically decrease its carbon footprint, which is good for the environment and business.

Studies show that most customers prefer to do business with organizations that adopt sustainable business practices. By switching to solar, you can show your customers you’re committed to sustainable business practices, earning them their loyalty.

Get the Exact Cost of a Solar Panel System for your Business

To get an accurate cost for your business's solar panel system, the first step is to request a custom quote. With this quote, you'll gain valuable insights with a comprehensive installation cost breakdown, a preliminary design of your system, as well as the various incentives available to you, ultimately providing you with a clear understanding of the payback period and return on investment.

If you're not quite ready to request a quote, don't worry! We've got you covered. Use our Solar Savings Calculator to get an immediate estimate of the price and savings you can expect. It's a quick and easy way to see how solar can benefit your business.

You can also view The Solar Energy Channel on YouTube for short, educational videos that cover all things solar. Don't forget to subscribe while you're there!

Last updated on February 2024.